Identifying opportunities for travel insurance growth in Latin America

Alejandro Alvarez, Senior Director at Americas Market Intelligence, and Ronaldo Gomes, a subject matter expert for the insurance industry, share with ITIJ some of the key challenges and opportunities for travel insurance and assistance in the largest Latin American markets

Latin America offers both challenges and opportunities for travel insurance and assistance providers. Brazil, Mexico, Colombia, and Argentina have the largest populations and the most developed markets for these service offerings.

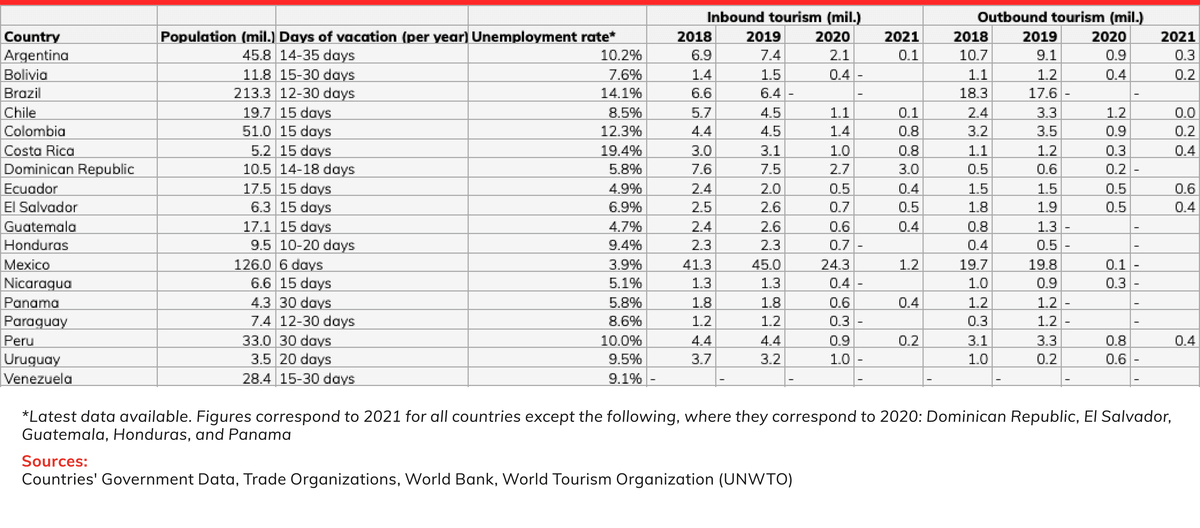

Both inbound and outbound tourism across the region were hard-hit by the effects of the Covid-19 pandemic (see Table A). However, product penetration has grown post-pandemic and many tourists will not travel without insurance any more – either through their own choice or as a result of government regulation. A June 2020 survey by travel assistance provider Universal Assistance revealed that 88 per cent of Latin American travellers now see travel health insurance as essential to their travel plans. And leading players such as Argentina’s largest airline, Aerolineas Argentinas, now include travel insurance in their product offerings, which they did not consider before the pandemic.

Shared language creates synergies, but lack of assistance remains a concern

With the notable exception of Brazil, the region’s predominant language is Spanish, which creates all types of synergies for the industry, and facilitates regional travel. Also, Latin Americans share a common cultural background, which makes it easier for companies to pilot regional businesses, market their message uniformly and manage cross-border operations. Lastly, the region’s travellers value family time and usually have the opportunity to enjoy it: on average, employers in Latin America provide 15 days of vacation days per year. (see Table A)

However, the pandemic and its costly quarantines have depleted the savings of many middle-class Latin Americans. Record unemployment decreases consumers’ ability to enjoy vacation time and has led to cuts into their disposable income. For the time being, international travel in Latin America is a luxury enjoyed by a smaller niche market.

Building and supporting insurance distribution networks

Across most countries, digital distribution networks will continue to grow, and with them, important innovations in customer service will follow, especially in the more advanced markets such as Mexico. Assistance validation without insurance companies’ pre-authorisation; customer service streamlining; and technology investments across all areas of the operations, especially application programming interface (API) connectivity to major databases, are all key to success and showcase the single greatest common opportunity for players in the industry.

And with an unending list of exotic destinations, domestic tourism in Latin America will remain strong and cater to larger volumes of travellers than international tourism. Providers with capabilities to build strong nationwide networks will gain an edge by fully managing their loss ratios and incurred but not reported (IBNR) claims, which ultimately reflect in more competitive premium costs.

Brazil's travel insurance market

Domestic tourism is strong in Brazil, with 81 per cent of potential travellers travelling domestically in 2021. The longest country in the world, stretching some 2,730 miles (4,395 kilometres) from north to south, Brazil has thousands of destinations that appeal to locals, such as Porto Seguro (Bahia), Maragogi (Alagoas), and Porto de Galinhas (Pernambuco). Domestic tourism has been outpacing international tourism in Brazil since before the pandemic. Travel insurance demand in Brazil grew by 10 per cent between 2018 and 2019, according to data from Assist Card, the market leader for travel insurance in Brazil. Growth was driven mainly by domestic tourism, which represented 47 per cent of the company’s total travel insurance sales in Brazil, compared to 37 per cent in the previous year.

A quickly developing market, Brazil nonetheless has stringent regulations. The country is unique in Latin America in that it classifies travel insurance as regular insurance, which implies minimum capital requirements for companies and strong government oversight. It is comparatively more difficult to enter the Brazilian insurance market when compared to those in other Latin American countries.

As such, a welcome change comes from Brazilian insurance regulator Susep, which is seeking to implement an open insurance model based upon information sharing to make it easier for clients to shop around for the best product offerings, and for insurers to have access to the customer data from clients who agree to share it. The initiative, which doesn’t yet have a defined implementation schedule, may also allow insurers to skip brokers and serve the public directly. This would inflict yet another blow to brick and mortar travel agencies, who already lose share to local online travel agencies such as decolar.com, 123milhas.com, and hoteis.com. Only the largest agents (CVC, Abreutur, and Flytour) might survive in Brazil in the long term.

In 2017, only 35 per cent of Brazilians purchased international travel insurance, and as little as 15 per cent purchased it when travelling domestically. An increasing interest by travellers to have insurance post-pandemic will surely drive growth in the industry. Assist Card reports that in 2021, it sold 10 per cent more travel insurance policies in Brazil than it did pre-pandemic – in spite of a comparatively lower traveller flow.

Table A

Click to enlarge

Mexico’s inbound and outbound market

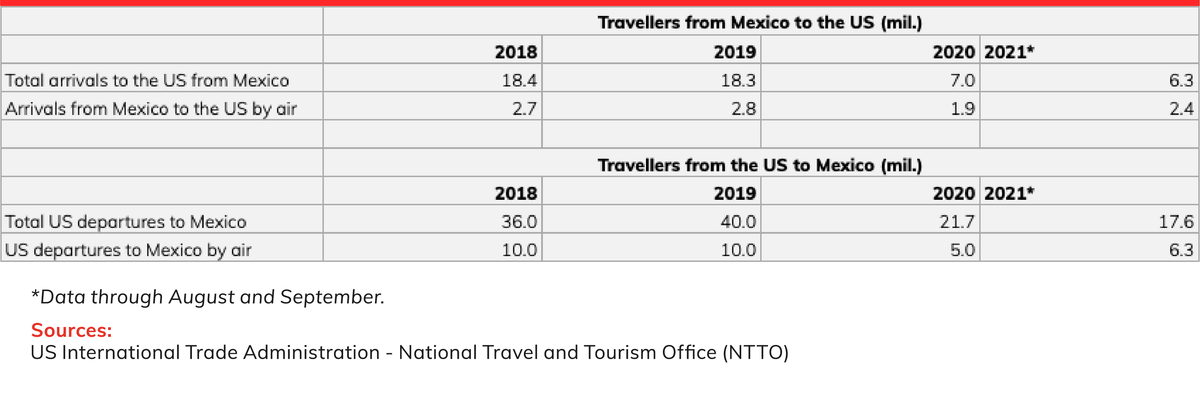

Next door to the largest outbound travel market in the world, Mexico is uniquely positioned as an international tourism destination. Before the pandemic, 40 million US visitors entered Mexico and 18 million Mexicans travelled to the US each year, with land travel rivalling all other means of transportation. (see Table B) Car rental insurance is an active and competitive market as a result.

Tourism to the Caribbean from Mexico, especially for cruise lines, is also well developed and product penetration is on the rise. According to Allianz, in 2017 only 27 per cent of Mexican families acquired travel insurance when travelling abroad, and only 10 per cent did so for domestic travel. Now, Assist Card estimates that 60 per cent of Mexicans purchase travel insurance when travelling abroad, which includes not only travel medical insurance, but also trip cancellation insurance and coverage against flight interruption and delay, which have been especially relevant as countries all over the world are unexpectedly closing their borders to prevent the spread of disease.

Overall, the Mexican travel insurance market is competitive and mature – by Latin American standards. Many of the largest insurance providers in the world already operate in Mexico, including Allianz, Chubb, and AXA. Active players in assistance include iKé, and MAPFRE Asistencia.

More than exploring new distribution channels, new and existing players may find an opportunity to leverage global distribution systems (GDS) such as Navitare and Sabre, and start-up Wooba. Airlines, travel agents and major players share tourists’ information including destinations, group sizes, and hotels, among other key data points, which can be analysed to develop customised insurance offerings.

Table B

Click to enlarge

Argentina’s potential for growth in travel assistance

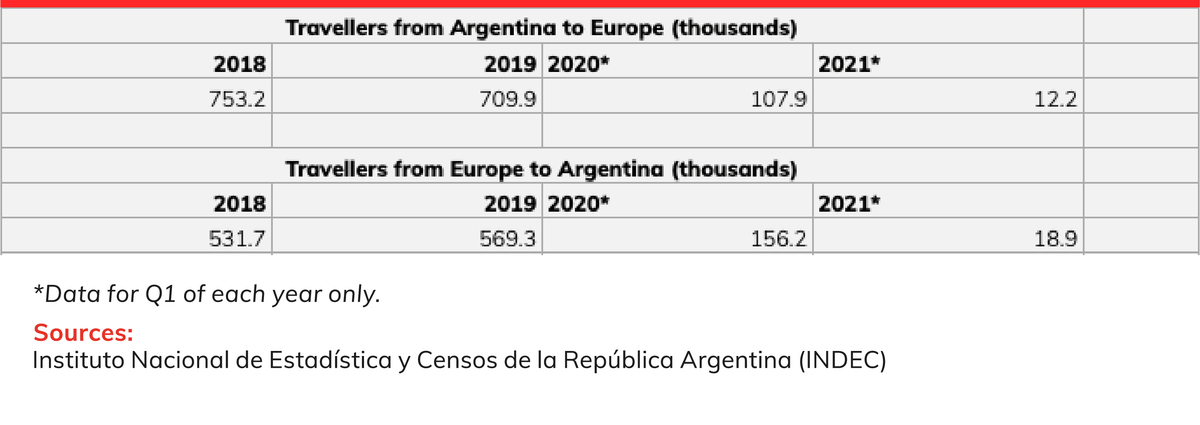

Argentina boasts a unique cultural affinity with Europe among its Latin American neighbours, and a large travel volume both inbound and outbound ensues. Before the pandemic, an average of 700,000 Argentinians travelled to Europe every year, while an average of 500,000 Europeans visited Argentina every year (see Table C).

Domestic tourism is also strong. For example, Bariloche is an important year-round destination, including winter skiing, which attracts tens of thousands of visitors from Buenos Aires each year. Assist Card operates its own medical centre there; a pilot project in Latin America and a unique initiative for assistance providers to directly manage their own networks. The Argentinian market is dominated by Assist Card and Universal Assistance.

Helping these two companies expand their networks and improving post-sales customer experience may present the greatest short-term opportunity in this market. Customer experience is decisive to Argentinians, especially to reduce a users’ need to undertake out-of-pocket expenses; to provide emotional support when filing a claim; and to offer support in Spanish along the way. PaxAssistance, led by former Assist Card CEO Alexia Keglevich, is a start-up focusing on customer experience that will surely gain travellers’ attention due to their emphasis on emotional support during emergencies.

Argentina, once the fifth-wealthiest nation on earth, has suffered continuous economic decay for decades. Once boasting the largest middle class in Latin America, Argentina is now as polarised in its wealth as Mexico or Peru. But there is still an important, affluent segment in Argentina that drives outbound travel, and the growing diaspora of expat Argentines living abroad will help keep in-bound traffic at robust levels.

Table C

Click to enlarge

Colombia's travel and insurance market

Colombia boasts the most diverse ecology in the world and is brimming with regional, cultural and geographic diversity that fascinates those who are willing to visit. Domestic tourism is strong, especially today, when the currency is undervalued. That said, domestic tourism destinations remain underdeveloped and struggle to accommodate the huge potential demand. Caribbean resorts such as Santa Marta, San Andrés and Cartagena face infrastructure bottlenecks that impede future growth. Many other destinations are small and underserved by highways and air routes, the latter being costly and hub-connected via Bogotá.

Colombia has been unable to raise international fascination in any one singular destination the way that Peru has successfully done with Machu Picchu. Colombia also suffers from an – outdated – image of violence and insecurity, even though today it is a safer country than Mexico or Brazil.

However, with over three million Colombians living abroad, their regular visits home drive much of the inbound traffic volumes. Most relevantly, Colombia is a robust outbound international tourism market, with over 3.5 million Colombians leaving home in 2019 to travel first to the US, but also to Mexico, Spain, Panama, and Ecuador.

Latin Americans in general desire self-service: being able to book and manage claims digitally is the norm across the region. Leading carrier Avianca has partnered with Iké to offer consumers travel insurance when purchasing plane tickets online, an example of effective synergies.

Taxes are comparatively higher than in most Latin American countries, especially added value tax, which discourages Colombian travellers and international insurers, who experience higher costs when fulfilling claims. Since 2015, the Colombian Peso has devaluated close to 40 per cent against the US dollar, and international travel has become prohibitively expensive for many.

Financial education and awareness is low, which presents an opportunity for companies in the travel insurance business to develop product usage. In 2018, half of Colombians were not aware that travel insurance even existed, and 28 per cent of travellers from Colombia openly refused to purchase travel insurance, according to Assist Card.

Education campaigns will help drive consumers’ interest in travel insurance. Less is known about Colombian travellers’ preferences than in the other countries, and newer offerings such as coverage for travelling pets may help drive growth. Perhaps existing players in Colombian markets will enter the travel insurance business, much like Sura, the largest insurance company in the country, which has leveraged its strong brand recognition to directly compete with travel assistance providers.

Latin American tourism set to increase

Domestic and regional tourism in Latin America is likely to increase as the region’s currencies struggle versus the US dollar, thereby discouraging international travel. In the largest economies, travel insurance suppliers tend to be highly consolidated, thus the best opportunities exist for assistance providers to cater to incumbent players. Insurers will benefit from investments in customer experience that emphasise digital driven self-service, as well as the creation or enhancement of provider networks to better manage claims and offer more competitive premium pricing.